My favourite reading, listening and watching of 2023

At the end of every year I look back on the previous 12 months and pull out the best things I’ve read, watched, or listened to.

This year, I devoted a significant amount of time to exploring topics that I would categorize as “surprisingly important, yet not widely discussed.”

The Purpose of Wealth?

When we formed our new firm in February of this year, we decided to call it Sapient Capital. Sapient means “acutely insightful and wise.” Put simply, wisdom is knowing what’s important. It’s the ability to pursue what you love and ignore what you don’t. The foundation provided by wealth can provide that freedom.

Curiosity helps show you what you love, so it’s a core driver of the pursuit of wisdom. I believe it is a force that can guide us to a far superior place that our limited-but-loud egos. It’s also much more powerful and mysterious than we typically give it credit for. I’ve found compelling support for this idea from at least six different fields. As a result, the central idea of this year was exploring the mystery of curiosity.

Curiosity was also at the core of the single best essay I read this year, Paul Graham’s How To Do Great Work:

Curiosity is the best guide. Your curiosity never lies, and it knows more than you do about what’s worth paying attention to.

Notice how often that word has come up. If you asked an oracle the secret to doing great work and the oracle replied with a single word, my bet would be on “curiosity.”

That doesn’t translate directly to advice. It’s not enough just to be curious, and you can’t command curiosity anyway. But you can nurture it and let it drive you.

Curiosity is the key to all four steps in doing great work: it will choose the field for you, get you to the frontier, cause you to notice the gaps in it, and drive you to explore them. The whole process is a kind of dance with curiosity.

Thanks so much to those of you that welcomed me as a guest on your podcasts this year. The interview that probably does the best job of explaining this year’s theme, specifically in relation to wealth management, was my appearance on Barron’s Advisor with Steve Sanduski.

Markets and investing.

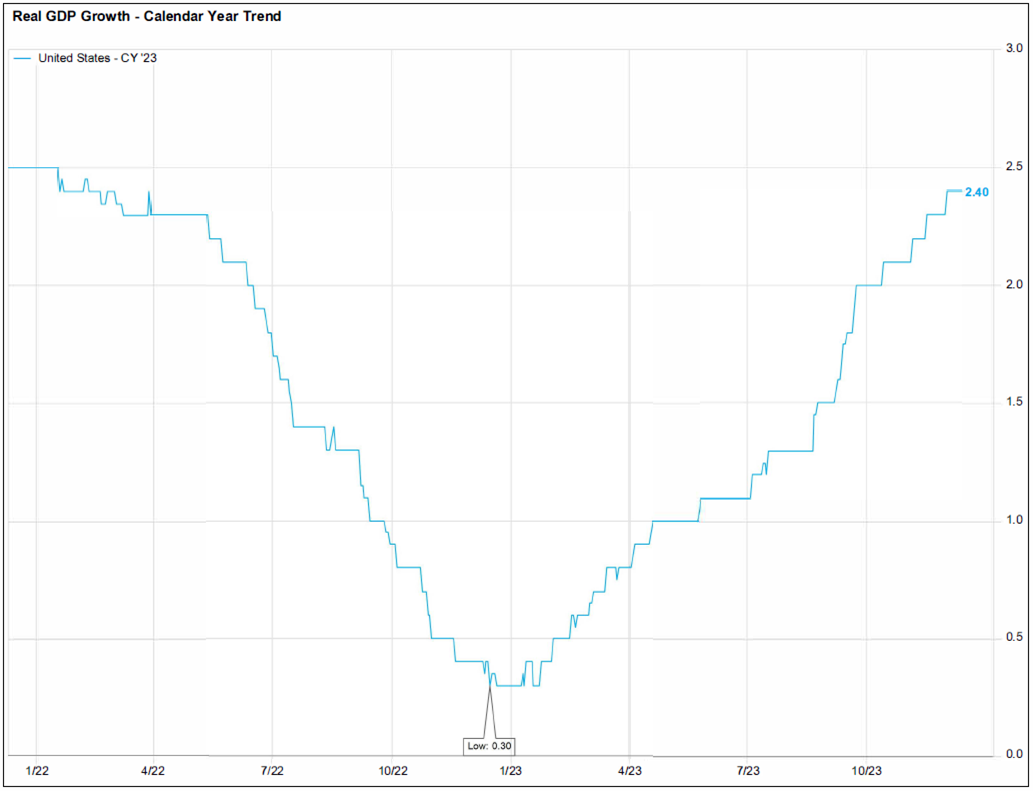

Chart of the year (h/t to TKer by Sam Ro ), I’m calling it “the U-Turn.” This is how rapidly the consensus had to revise their negative forecasts for the U.S. economy. You’re unlikely to find a clearer example for why you should pay attention to the Wall Street consensus, if only to bet against it.

My most popular finance piece was Wealth, Five Formulas and a Recipe (the power of listicles!). I also wrote short articles about about the impact of higher rates, investing red flags, the global capex paradox, Chinese stimulus and (obviously) AI. The short piece I was most proud of was actually about six key things to look for when reading any piece of financial content.

Sapient Capital Partner Mike Hall wrote a typically thoughtful article titled “I Don’t Know” about humility in the face of uncertainty, and how good wealth managers prepare rather than predict. Sapient Partner Tom Pence also recently shared his views on the delicate balance we see in markets going into 2024. In summary:

- We are nearing the end of the post-covid normalization. The last remaining pieces to normalize are rates and US Fiscal Policy.

- Core CPI ex-shelter is now at or below 2%. Using market rents, it is BELOW 2%. Inflation could continue to surprise on the DOWNSIDE as we progress through 2024.

- There is a risk that a resolute Fed could OVERSHOOT on inflation and delay rate cuts until much later than needed, causing the 10-year to slip BELOW 3%.

- AI, work-from-home and advancements in automation & robotics could potentially produce the long-awaited resurgence in labor productivity.

- Both China and Europe remain in a state of disinflationary pressures which could carry over into the global economy.

- We are still expecting a 1H soft patch in US with earnings flat to down slightly.

- Stock earnings yields of around 5% appear reasonably valued relative to current bond yields.

- The US and global economy will resemble a cyclical upturn once the Fed begins cutting rates in earnest. Early cycle and commodity stocks should fare well. A weaker dollar will contribute to commodity strength.

- Bonds should do well after posting two sequential years of returns that rank in the lowest quartile of the past 100 years.

Outside of Sapient, my favourite investing podcast was High-Quality Investing with William Green and Christopher Begg. In my opinion, Chris is uniquely good at embodying the principles of curiosity, lifelong learning and wisdom within an investing context.

Frederik Gieschen emains my favourite finance writer. His piece Behind The Curtains of Buffett’s Life with Alice Schroeder was phenomenal. In the oceans of ink spilled on the icon, Frederik unearths the human, helped by Schroeder’s whopping 2,000 hours of interviews. A lot of Frederik’s sources for her insights are now in obscure corners of the internet. I also wrote a longer-form piece about what we get wrong about Charlie Munger (RIP) and Warren Buffett’s investing style.

I also really enjoyed 15 Ideas, Frameworks, and Lessons from 15 Years by Newfound’s CIO Corey Hoffstein. He offers a lot of great insights on the nature of risk, portfolio construction and modern investing and trading. I found his last comment resonant with my own investing experience:

This final lesson is about a mental switch for me. Instead of seeing something and immediately saying, “the market is wrong,” I begin with the assumption that the market is right and I’m the one who is missing something. This forces me to develop a list of potential reasons I might be missing or overlooking and exhaust those explanations before I can build my confidence that the market is, indeed, wrong.

Books.

My clear favourite this year was Peter Kingsley’s Catafalque (I wrote about it here). It’s probably the first time I’ve read three books by the same author in a few weeks (and it would have been four if my Amazon delivery of Reality had arrived in good time).

Catafalque is a dark and mysterious examination of Carl Jung’s prophetic role in exploring the nature of a guiding intelligence outside of our rational minds. But it’s also about his brutal realization that the transition to this mode of being could be difficult to the point of fatal. My only truly viral article of the year was What Nobody Tells You, about the hellish difficulty of navigating this kind of life transition.

One of the most important new themes to emerge from my learning this year was a deeper understanding of the tragic loss of initation processes for personal growth. They are a lost solution to a problem we haven’t even been willing to diagnose, and might be the root cause of a knotty cluster of problems we’re struggling to solve as a society. I’m currently reading Bill Plotkin’s The Journey of Soul Initiation which makes this tragic loss even clearer (podcast introduction here). The biggest incremental idea for me this year was that these rebirths are primarily meant for the good of the entire community, if not the world, rather than exclusively for personal growth. The Emerald Podcast, especially their episode on intuition, has a been a big factor in helping me learn more about a hidden world our culture is currently neglecting at its peril.

On that topic, another huge surprise was Mona Sobhani’s book Proof of Spiritual Phenomena (I wrote about it here). Her key conclusion was that the evidence for the reality of “psi” (pre-cognition, telepathy, remote viewing and clairvoyance) is on par with that for other established psychological phenomena, although there is no current understanding of the mechanisms behind them. This not only forced me to consider my priors when it came to a vast number of my unchallenged preconceptions, it led to a friendship that was one of my greatest gifts of the year.

Film and TV.

We didn’t watch that much this year. But The Bear (both seasons) was the standout for us, especially the soundtrack.

Of the relatively few films I watched, Terrence Malick’s A Hidden Life was both gorgeous and profound, but at least 40 minutes too long.

Music.

Regular readers know I’m very much into working to melodic house. The best set I heard this year, although not from this year, was Luttrell on Anjunadeep.

My love to you and your families, and a very happy new year.

Some other great Year End Highlights pieces.

- Read. My Favorite Investment Writing of 2023 by Nick Maggiuli

- Why read. Nick has great taste, so this is a superb selection of some great wealth and investing pieces from 2023.

- Read. Something New on Wall Street for 2024 — Humility by John Authers

- Why read. John’s daily email has stubbornly worked its way into my daily rotation by simply being really good. Recommended. This is a snappy rundown of all Wall Street’s forecasts for 2024.

- Read. Wall Street’s 2024 outlook for stocks by Sam Ro at TKer

- Why read. Likewise Sam Ro’s TKer is a short, simple and snappy newsletter that’s good for keeping up with markets. It’s superficially fashionable to mock Wall Street’s year-end forecasting process, especially the somewhat arbitrary price targets. But that’s neglecting the fact that the consensus is always valuable! Everyone and their mother forecasting a recession this time last year was a blindingly obvious recent example.