Introducing a new monthly collection of insights.

[6 minute read].

This is a new monthly piece where Sapient Capital brings you the most interesting and actionable ideas on wealth, investing, money and lifestyle.

As always, please contact us with questions and comments. You can request a meeting with us here.

Four Insights from Sapient:

#1: Market Update: The big story this month was hotter-than-expected inflation forcing a U-turn in Federal Reserve rate cut expectations. Thankfully Sapient’s Josh Shneyderov has a brief video (below) updating you on our thoughts on Fixed Income.

Elsewhere, the “Magnificent 7” stocks continued their unprecedented dominance of global markets. They now account for a third of the S&P 500’s entire post-financial-crisis gain. Their combined market capitalization is now equivalent to the second-largest country stock exchange in the world. Microsoft and Apple each have similar market caps to all the combined listed companies in each of France, Saudi Arabia and the United Kingdom.1 Nvidia’s $277bn gain on Thursday alone was the by far biggest single-session increase in value ever.2

As a reminder, following his 2024 outlook letter and webinar, Sapient’s Tom Pence remains cautiously optimistic on both stocks and bonds.

#2: Video: What’s Happening in Fixed Income? by Josh Shneyderov, Managing Director, Investment Management. (6 minute watch).

With so much volatility in the fixed income markets in the last year, we are excited to bring you a brief five minute market update from Sapient’s Head of Fixed Income, Josh Shneyderov. As always, please contact us with questions and comments.

#3: Wealth Planning Focus: The 2026 Gift Tax Exemption by Emily Salatich Macintosh, Director, Trust & Estate.

The Federal Estate and Gift Tax Exemption amount has reached a historical high this year of $13.61 million per taxpayer ($27.22 million for married couples). This exemption shields transfers made during lifetime and/or at death from the 40% estate and gift tax rate. However, the laws that granted this tax relief are set to expire at the end of 2025, and (without legislative change) the exemption amount will “sunset” to ~$7 million per taxpayer (~$14 million for married couples) beginning in 2026. For those facing tax exposure, it is important to revisit your estate planning and make lifetime use of this exemption while it is still available. Please call your advisor with any questions.

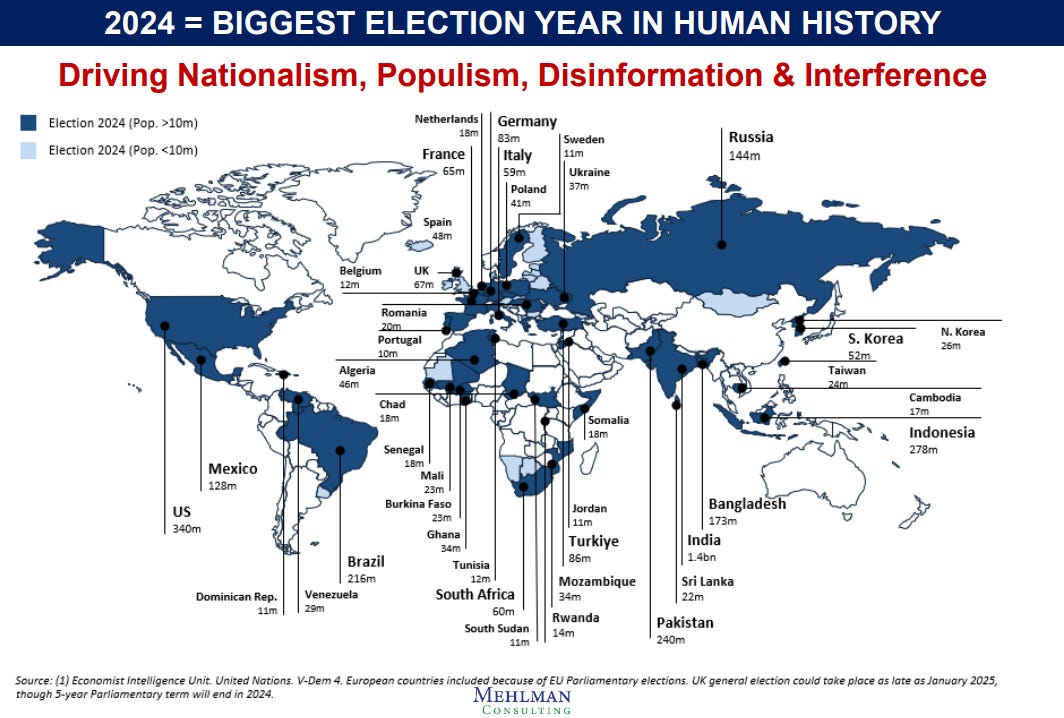

#4: Article: Geopolitics in 2024: A Year of Surprises by Tom Morgan, Director, Communications. (5 minute read).

Our expectation is that the geopolitical picture is likely to become increasingly unstable. We are seeing an unfolding trend of proxy wars in unexpected areas like Latin America, Africa, subsea and even space. The latter was an insight which ended up being immediately topical, in light of last week’s breaking news on Russian anti-satellite capabilities. From an investment perspective, energy, inflation and gold may end up becoming the key beneficiaries of this volatile outlook.

[Tom also wrote one of his monthly thematic pieces about the massive benefit of shifting your mindset in a neglected direction “For The Person Who Has Everything.”]

Chart of the month:

Four Other Things We Enjoyed:

1. Read. Information That Would Get Your Attention by Morgan Housel (11 minute read).

- Key quote: “What would be the most interesting and useful information anyone could get their hands on? Years ago I asked that question to Yale economist Robert Shiller. ‘The exact role of luck in successful outcomes,’ he answered. I loved that answer, because nobody will ever have that information. But if you did, your entire worldview would change. Who you admire would change. The traits you think are needed for success would change. You would find millions of lucky egomaniacs and millions of unlucky geniuses. The fact that it’s impossible to possess this information doesn’t make it useless – just thinking about how powerful it would be to have it forces you to ponder a topic that’s important but easy to ignore.”

2. Read. Summary of the KKR Family Capital Survey from Off The Charts (4 minute read).

- Why Read. This is a generally great charts-based Substack. This week they offered highlights from KKR’s Family Capital Survey. Family offices tend to have higher allocations to alternatives than other types institutions (mostly PE/VC). Real assets have become more of a focus as stocks and bonds have become more correlated post COVID.

3. Read: How to Have Meetings That Don’t Suck by NZS Capital (24 minute read)

- Key quote: “Meetings don’t have to suck. As we begin to align incentives, assign homework, expect preparedness, eliminate hierarchy, and cultivate an environment of trust, meeting productivity skyrockets. There’s an aspect of holding meetings in this manner that becomes deeply uncomfortable. We must truly listen to others’ opinions and encourage them to call out our own persistent biases in the process. No matter how much we trust others, having our shortcomings highlighted never really feels great in the moment. However, that’s the price of growth.”

4. Watch. Artificial Intelligence and the Future of Advice by Jason Pereira (40min watch)

- Why watch. Sapient attended the 2024 Exchange Conference in Miami. Sapient’s Tom Morgan presented on the importance of wealth as a facilitator of curiosity. The highlight of the other presentations was Jason Pereira on A.I. tools. He outlined a spectrum of practical and mindblowing ways we can use A.I. to enhance our daily working lives.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Sapient Capital, LLC (“Sapient Capital”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Sapient Capital and its representatives are properly licensed or exempt from licensure. For additional information and important disclosures, please visit our website at https://sapientcapital.com

2. Source.