Swarms, shipping, submarines and space

[5 minute read]

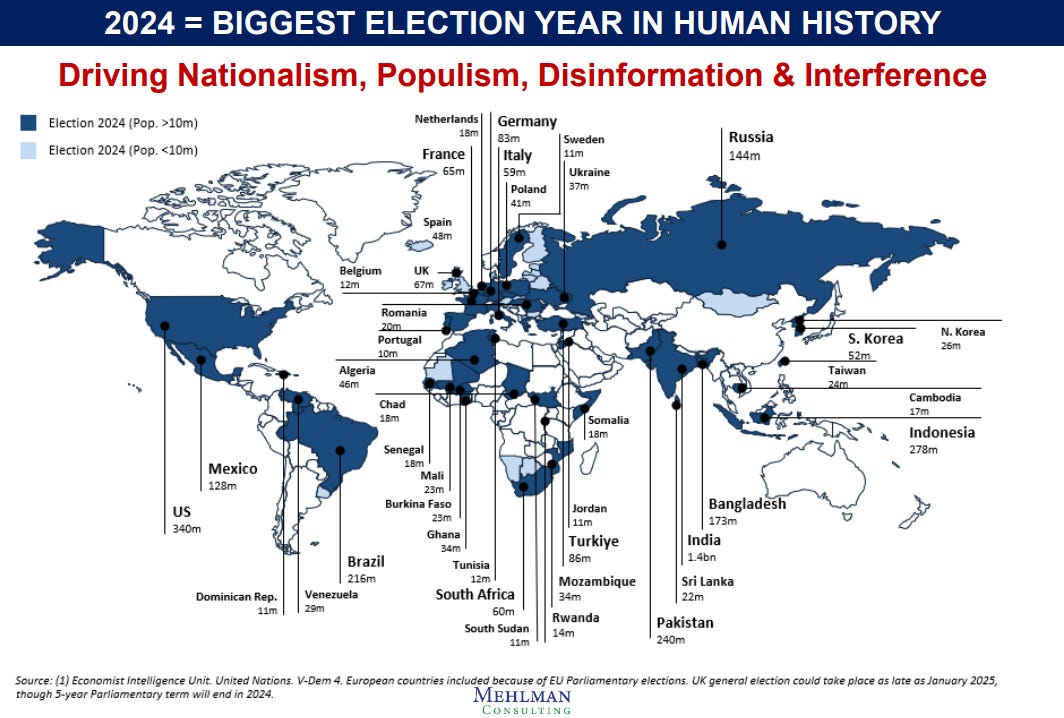

The year has barely started, and the U.S. Presidential Election is already dominating the national discourse. But it’s not just America; countries home to nearly half of the world’s population (and 7/10 of the most populous countries) are going to the polls this year. That’s something that’s never happened before in human history.1

As Sapient’s Tom Pence noted in his 2024 Markets Outlook, historically, U.S. presidential election years are quite good for the market. But in 2024, the eventual “winner” could emerge with the lowest popular vote percentage in history. This would make the U.S. election an unusually disruptive geopolitical event. And this is before we’ve been truly tested by unfathomable recent advances in A.I. disinformation.

This year of potential turmoil is unlikely to be a uniquely U.S. phenomenon. It’s obvious that geopolitical instability is increasing, although a hot-war between major powers remains mercifully unlikely due to the apocalyptic consequences. This is leading to an observable increase in proxy wars in regions like Ukraine and the Middle East. While even the most horrendous human tragedies tend to have limited market impact, that’s no reason to be complacent.

Our research partners at Gavekal have dubbed energy the “antifragile asset”: when things go wrong, it tends to go up. There are multiple serious geopolitical risks to global oil supply. For example, Saudi’s Abqaig refinery is responsible for ~7% of global oil output and Iranian Cruise missiles have already penetrated its defenses once before.2

Global shipping lanes are wildly disrupted and will remain so (and this will be inflationary). The Panama Canal is currently drought-stricken, and insurance carriers won’t cover Red Sea routes until the Houthi threat is eliminated. The U.S. Navy isn’t well positioned for a Gulf crisis currently. The narrowest point of the Red Sea is only 20 miles across, from Yemen to Djibouti. China’s only overseas naval base is in Djibouti and, so far, they have notably done absolutely nothing to ease disruptions.

Within Asia, we’re seeing a significant arms race in the Western Pacific and Indian Ocean. This is the region where Xi is expected to be most aggressive. The Chinese regard the South China Sea as their Caribbean and have defensively reinforced the island base region named the “Great Wall of Sand.” The Philippines are perceived as a fragile U.S. ally, so we should expect our enemies to test U.S. resolve there. North Korea is enraged at the recent South Korean and Japanese rapprochement, which will further contribute to regional instability.

One of Sapient’s core philosophies is to focus on overlooked, but important, themes.

We have recently enjoyed reading the geopolitical insights of Pippa Malmgren. she drew our attention to the increasingly disruptive impact of “swarm warfare.” For example, America’s enemies are increasingly using organised crime, based in Ecuador, to destabilize us domestically. Information warfare, cyberattacks, drones and mercenaries are all taking on a larger role. For example, U.S. Special forces have never been more active in Africa than they are currently.

Space is emerging as simulteously one of the the most important, yet most neglected, theaters of war. Lest this sound like literal science fiction, the Pentagon publicly declared it the “most essential” domain just a couple of weeks ago. Space, and the subsea cables that dictate everything from WiFi to GPS, are obviously increasingly strategic assets. Hence we should all be watching both the skies and the subs.

Space is not just a source of risk, but of almost incomprehensible longer-term opportunity. Space solar technology could be able to generate high-intensity energy which can be beamed down to receiving stations on earth. There are also discussions about putting nuclear fusion-generation facilities on the lunar surface, causing a new race to claim moon territory by China, Russia and the US. Within the next 10 years we will witness more focus on asteroid mining for rare earths and other key raw materials, changing the calculus for depleting reserves on earth. For example, the asteroid Psyche has been identified as having a resource base worth $10 quintillion, or 700x the value of the annual world economy.3 Space is also emerging as a laboratory environment for chips, 3D printing and pharma due to its unique physics. Space travel will increasingly be about robots and AI, not human astronauts. Russia and China are on track to set up a moon base by 2036.

Bringing our focus back to the immediate present, our expectation is that the geopolitical picture is likely to become increasingly unstable. Energy, inflation and gold may end up becoming the key beneficiaries of this outlook. We will continue to bring you our insights and recommendations as events evolve.

Related Reading

- Read: Trust Fall: Politics and Policy, 2023 Take-aways and 2024 Look-aheads presentation by Mehlman Consulting.

- Why Read. I enjoyed this presentation from D.C. Consultant Bruce Mehlman. The central dynamic of the last few years in Western politics has been a catastrophic decline in trust. Whether it’s media, politics, culture or education we’ve rarely been so divided.

- Read. Swarm Geopolitics: Everything, Everywhere, All at Once: Hamas, Houthis, SMERSH, Spies, Ecuador and Organized Crime by Pippa Malmgren (29 minute read, paywalled).

- Why Read. Pippa has proven a stimulating resource on neglected corners of the geopolitical landscape. This excellent essay outlines the surprising geopolitical impact of organized crime in the Amazon.