2024 Market Outlook From Tom Pence

[Please join Tom Pence for a live 2024 outlook webinar at 1pm ET this coming Thursday 18th January. Register here]

Listen to a 14 minute audio version of this letter here

Looking back at 2023

2023 began with a chorus of bearishness the likes of which we had not heard in many years. What seemed clear to most market professionals was that the U.S. Federal Reserve, in their effort to extinguish runaway inflation caused by the pandemic, was fully prepared to take the entire U.S. economy down in the process.

To many, it was not a question of whether we would have a recession in 2023, but when it would start and how deep it would be. Stocks were sold, cash was raised, hatches were battened down in anticipation of the worst. But fortunately, for those who remained invested, the guest of honor never showed up for that lugubrious party.

Instead, what was overlooked was the possibility for a resilient economy bolstered by the three pillars of GDP: government, business and consumer spending. As discussed in our Q3 letter, the economy continued to benefit from the current administration’s $2.7T in stimulus that drove public sector job growth to its highest level in nearly 20 years.1 With job security well entrenched, consumers were more than happy to continue burning through their COVID-era excess savings. This kept consumer spending elevated for goods and services and made it imperative for businesses to continue hiring and spending to rebalance inventories to pre-COVID levels. Additionally, AI-driven optimism in Q1 and the prospect of GLP-1 agonists becoming a cure-all wonder-drug contributed further towards driving the market to a new 12-month high by late May.

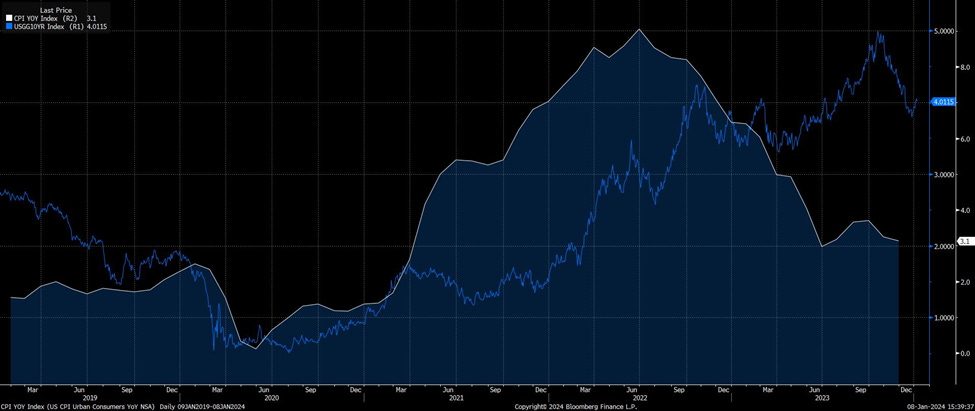

Nevertheless, the bearish chorus continued into the summer to warn us that the Fed would eventually get its way with inflation still hovering around 5% (though falling). There remained a reasonable likelihood that further rate increases and a recession were still on the horizon. Fortunately, none of this came to pass. The CPI kept falling (3% currently)2 while earnings, the consumer’s mood and the economy remained buoyant. When it became clear by fall that the Fed’s next move would be easing rather than raising rates, the 10-year yield fell from nearly 5% in late October to 3.88% by year-end (See Figure 1 below).3 Stocks welcomed this news with one of the strongest year-end rallies we have seen in years. The S&P 500 appreciated nearly 16% from the end of October to the end of the year.4

Figure 1: CPI vs. 10-Year UST Yield

So, what lies ahead for 2024?

Based on a combination of historical observations and an assessment of current economic data, we see 2024 being uniquely set up as the final year of this historic 5-year epoch in which the world over-reacted to the COVID-19 pandemic. This overreaction began with a near complete shutdown of the world economy, followed by an over-stimulation to get things restarted, which inevitably led us into the last two years where central banks have been trying to reverse the impact of that stimulus. Commonly referred to as the “post-COVID normalization”, we think 2024 will be the year in which we finally see full normalization of the last two pieces of this puzzle: interest rates and fiscal policy. But the path to full normalization will likely require that we navigate through some decidedly abnormal volatility.

Such volatility will likely be due to the fact that we still have a Fed seeking full vindication of its past aggressive rate increases, while hoping for the typical weakening of financial conditions from the negatively inverted interest rate curve they put in place 19 months ago.5 Put another way, Chairman Powell would probably like to see a recession begin unfolding before beginning rate cuts so that he can avoid the risk of re-igniting inflation and overheating the labor market. To us, that seems like a difficult needle to thread.

To be sure, 2024 has several headwinds ahead, most notably the easing of the effects of the three pillars of GDP growth we mentioned above. At the same time, there are several tailwinds that could result in the economy remaining stronger than expected and stronger than the Fed is hoping for. In fact, we think there is a real possibility that any slowdown experienced will either be shallow or short-lived. A variety of inputs lead us to this view, with the most noteworthy being the recent strength seen in employment data. The 62.5% labor force participation rate still has more potential to expand before it recovers to the pre-COVID levels of 63% or the pre-financial crisis levels of 66%.6 Keep in mind that growth in labor supply equates to growth in the production of goods and services – which ultimately keeps us on a favorable path towards finally bringing supply and demand back into balance and putting even more downward pressure on prices and wages.

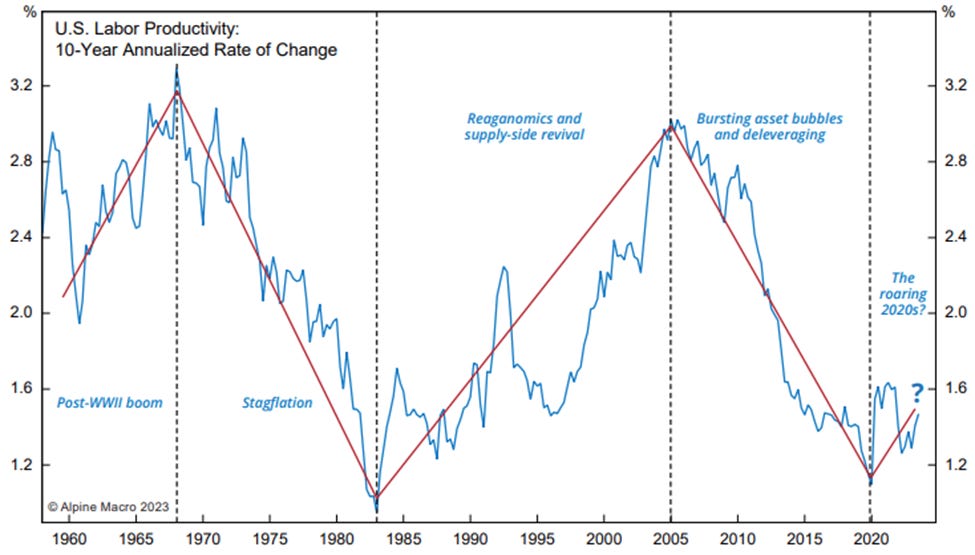

Another tailwind that could support the economy in 2024 is an increase in productivity. This occurs when labor is used more efficiently or when scalable infrastructure is advanced through capital investments or technological innovation. The U.S. used to get 1.5-3.5% of additional growth from productivity in the early 2000’s, but in the recent decade such gains have been virtually nonexistent until the past year when productivity accelerated to 2.4% (See Figure 2).7 With the advent of AI, new advances in robotics and automation, increased efficiencies in the acceptance of the work-from-home model and breakthroughs in new medicines, there is a real possibility that the recent increase seen in productivity data could be sustained.

Figure 2:

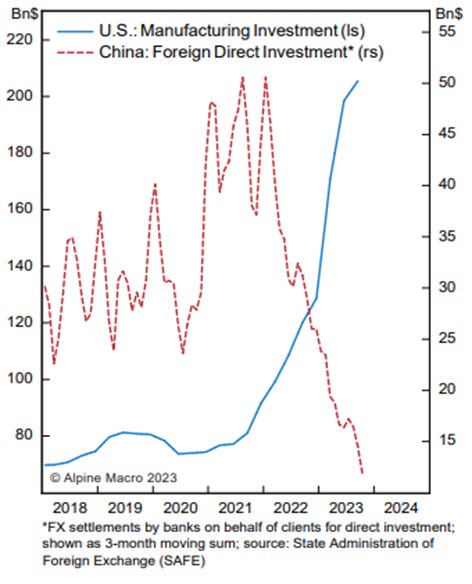

A third tailwind which could offset a meaningful recession in 2024 is the interplay between China and the West and the potential for China to be a source of deflationary forces that could further offset the post-COVID inflation faster than many expect. Since the start of a trade war between the U.S. and China that began in 2018, China has been perceived as an increasingly risky place to invest. This negative perception was further exacerbated by China’s behavior during the outbreak of COVID in 2020 and by Xi Jinping’s alarming anti-corruption campaign against Chinese politicians and CEOs. One implication of these actions has been a dramatic shift in foreign direct investment away from China and into the U.S. (and U.S.-friendly countries) by Western companies (as depicted in Figure 3 below).

Figure 3:

Geopolitically, now that Xi has allied China with Russia, threatened forced reunification with Taiwan, and undertaken an effort to expand the BRIC’s trading block to establish an alternative to the USD-based global financial order, relations seem likely to get worse before they get better. This has led the Hang Seng Index to its lowest level in a decade after four years of declines, the weakest IPO market since 2002, and an economy that is facing a debt-deflation spiral with rapidly decelerating GDP (currently 3.5% in Q3).8 Of concern, Chinese consumers are heavily indebted and interest rates are currently approaching 5%. This is particularly problematic since two-thirds of Chinese household assets are in property.9 A declining real estate market could result in a collapse in consumption and a severe weakening of domestic employment. Lastly, with manufacturing capacity in the Chinese auto sector currently running at 59%,10 China is in the process of further subsidizing exports to keep factories running. Such actions are likely to result in deflationary forces being exported into developed markets which could further push down U.S. inflation.

We think that the effect of all this will be the continuation of above-trend investment in the U.S. manufacturing base (“re-shoring”) while at the same time we could experience a dampening effect on the price of imported goods if deflationary forces intensify in China and make their way into the global economy.

Should the above transpire, it’s worth pondering how the Fed will respond.

Remember, Powell has stated that he wants to see some weakening in the U.S. economy before cutting rates.11 But what if the above three tailwinds keep the U.S. out of a recession while inflation continues to fall? Cutting rates in such a scenario could risk overheating the economy, something the Fed clearly wants to avoid. Nevertheless, while we think this could delay the Fed’s decision on WHEN to cut rates, we think it is inevitable that they WILL cut rates. Once this occurs, we think the economy will normalize and exhibit early cycle behaviors such as business reinvestment beginning sometime in early 2025. From our current vantage point, we think it makes sense to be positioned for some economic deceleration in the first two quarters of 2024 with the Fed capitulating on rates by the June FOMC meeting.

How to Invest?

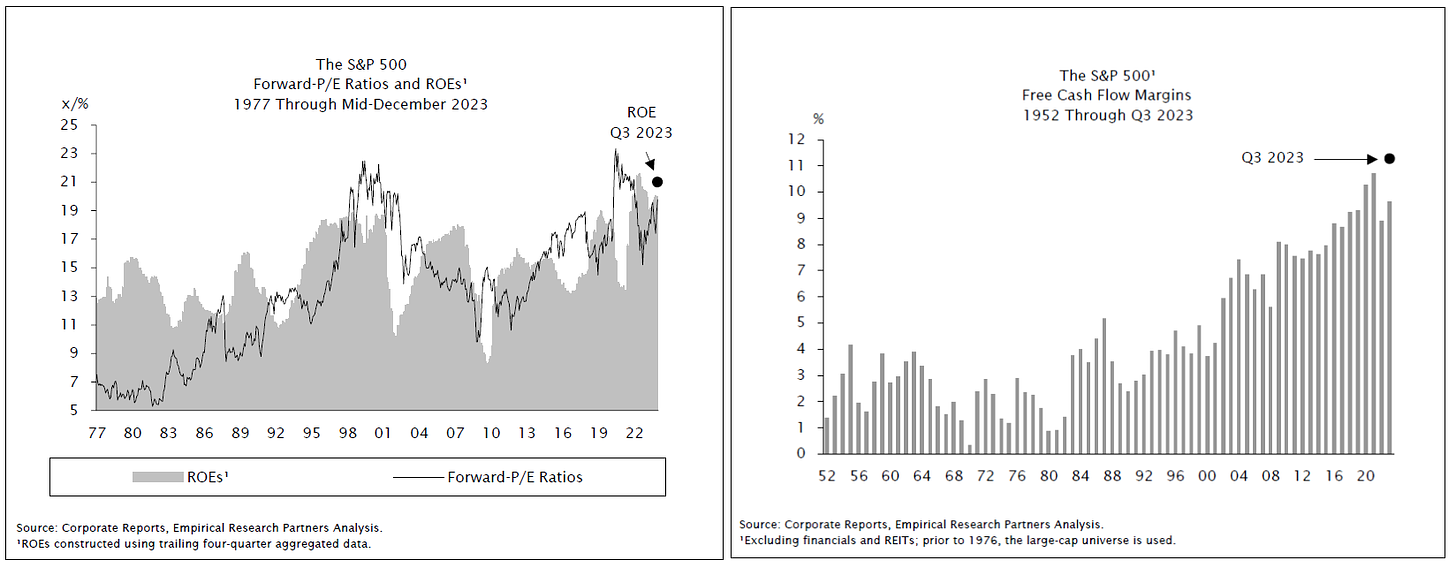

Considering these inputs, our current view is that both the stock and the bond markets hold the potential for significant upside in 2024 and into 2025. One challenging timing element is the strong rally in late 2023 that was likely correlated with this view. After a solid rally in both stocks and bonds at the end of the year, stocks (as represented by the S&P 500 index) are now priced at 19x 2024 earnings and those earnings are projected to grow by 10%.12 From a valuation standpoint, 19x earnings at a time when we are probably 12 months out from a re-acceleration in GDP is not abnormally high. In fact, looking at the inverse as earnings/price depicts the index to be reflecting a 5% earnings yield. This seems reasonable for a growing stream of earnings compared to the risk-free yield of 4% on 10-year treasuries.13 It is also worth reminding ourselves that such valuations are somewhat justified by the incredibly high ROE’s and historically high free cash flow margins that have persisted in U.S. stocks for the past few years (Figures 4 and 5).

While we expect to see some volatility into the first four months of the year as the growth and inflation pictures come into focus, we see the potential for yields to come down on both stocks and bonds once the Fed eases, inflation is tamed and growth re-accelerates. Keep in mind that bonds are overdue for a few good years after 2022, which turned out to be one of the worst years for bond returns in 100 years.14

Should lower rates prevail, 2024 could be a particularly good year for the IPO market, which in turn could breathe new life into the market for private companies, which were rather quiet in 2023 (particularly in the growth and venture sectors).

Normally, the most compelling sectors in the stock market to own when the 10-year treasury is falling are the typical growth sectors of communication services, consumer cyclicals, technology and healthcare. Much of the rally in the last quarter of 2023 was probably a reflection of this relationship. While we think these sectors should continue to outperform in 2024, early-cycle stocks in sectors such as consumer durables, energy, materials and industrials should also do well once we have made it through the worst of the slowdown expected in the first half of this year. This would include stocks of cyclical companies in manufacturing/automation, energy and metals/mining industries. Also, rate-sensitive companies such as homebuilders, automobile manufacturers, brokers and banks with healthy balance sheets.

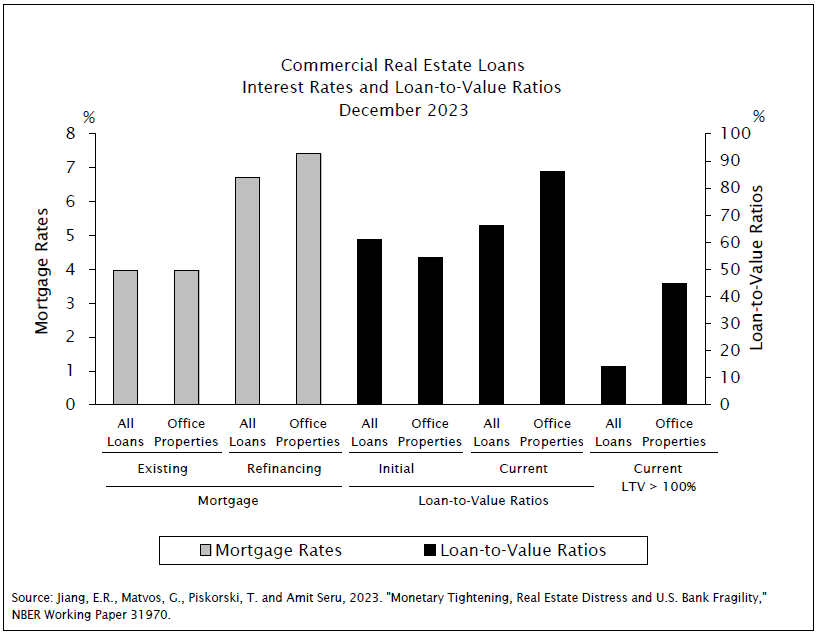

While banks generally could also get some relief as the yield curve returns to a positive slope, in the wake of the Silicon Valley Bank crisis of the spring, they have inherited a new reality of higher cost deposits, higher regulation and lower risk appetites. Specifically, regional banks still face a somewhat dubious outlook given their higher exposure to commercial real estate loans. Until the refinancing cycle in the commercial office space is fully behind us, it won’t be clear whether banks holding these loans were adequately reserved. Figure 6 below highlights the precarious state of refinancings and loan to value deterioration for commercial office properties.

Figure 6:

It should also be noted that with the possibility of a Fed easing cycle unfolding in the U.S., it is very likely that the dollar could experience weakness. While the dollar’s strength or weakness also depends upon the growth profile in the U.S. relative to the rest of the world (which has supported the dollar in prior easing cycles), a weakening dollar is usually associated with rising commodity prices. To be sure, while commodities such as oil, copper and aluminum will largely reflect the outlook for global demand/growth, a stable global outlook in the face of a weakening dollar could increase the impact of food and energy prices on the CPI. This is one of the reasons we remain positive on the global energy sector, particularly those companies involved in upstream production and refining where free cash flow yields remain at historically attractive levels.

Lastly, no outlook regarding 2024 would be sufficient without a mention of the upcoming presidential election. Historically, presidential election years are quite good for the market, which just adds a final tailwind to our outlook.15 Some Fed watchers have theorized that Powell may be politically motivated to cut rates early to keep the economy strong and reduce the possibility of having to deal with Donald Trump again. We doubt such biases will factor into their decision-making. Rather, we think that the Fed will have more than enough justification to cut rates based on the available data. What seems more interesting to us is the possibility that, should Donald Trump become the Republican nominee, we could see as many as three to four third-party candidates enter the race (Kennedy, Manchin, Stein, West). Depending on the state of the economy and the strength of the respective candidates come November, the eventual “winner” could win with the lowest popular vote percentage in history. This would hardly be perceived as a “mandate” and would present something for us to consider when thinking about what the realistic policy initiatives might be heading into 2026.

In Summary:

- Our current view is that both the stock and the bond markets hold the potential for significant upside in 2024 and into 2025.

- But it also makes sense to position for some economic deceleration in the first two quarters of 2024 with the Fed capitulating on rates by the June 30 FOMC meeting.

- Strong performance will likely continue in technology and consumer cyclical sectors in 1H with early-cycle sectors such as banks, materials, industrials, and homebuilders doing better in 2H.

-Tom Pence

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur. All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such. Sapient Capital, LLC (“Sapient Capital”) is a registered investment advisor. Advisory services are only offered to clients or prospective clients where Sapient Capital and its representatives are properly licensed or exempt from licensure. For additional information and important disclosures, please visit our website at https://sapientcapital.com

3 Bloomberg

4 Bloomberg

5. Bloomberg

7 https://www.bls.gov/news.release/prod2.nr0.htm

8 Bloomberg

9 Empirical Research Partners

10 https://www.just-auto.com/analyst-comment/the-polarisation-of-chinas-automobile-production-capacity/

11 https://www.federalreserve.gov/newsevents/speech/powell20231019a.htm

12 Bloomberg

13 Bloomberg

14. Bloomberg

15 Clocktower Group