A quick list of common warning signs

[3 minute read].

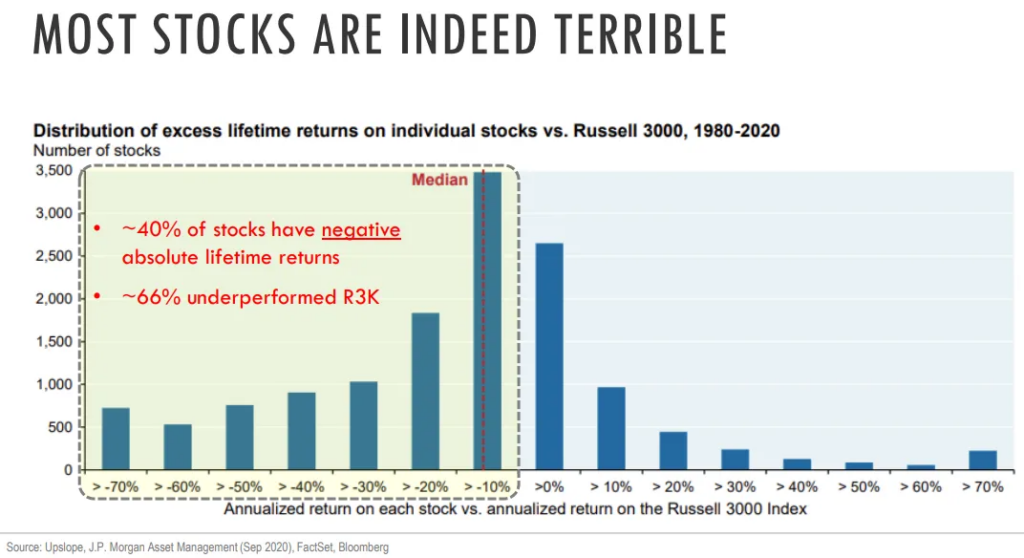

A great way to learn what to avoid in business and investing is to understand what a good short seller would look for. This is doubly important because I think we all underestimate how common business failure really is. Recall J.P. Morgan found that, from 1980-2020, around 40% of the time a concentrated position in a single stock experienced negative absolute returns.

Like Australia, the corporate world is filled with things that want to kill you. JPM has their own list of exogenous risks, from competition to technological obsolescence.1 But it’s just as helpful to consider the common features of self-inflicted wounds.

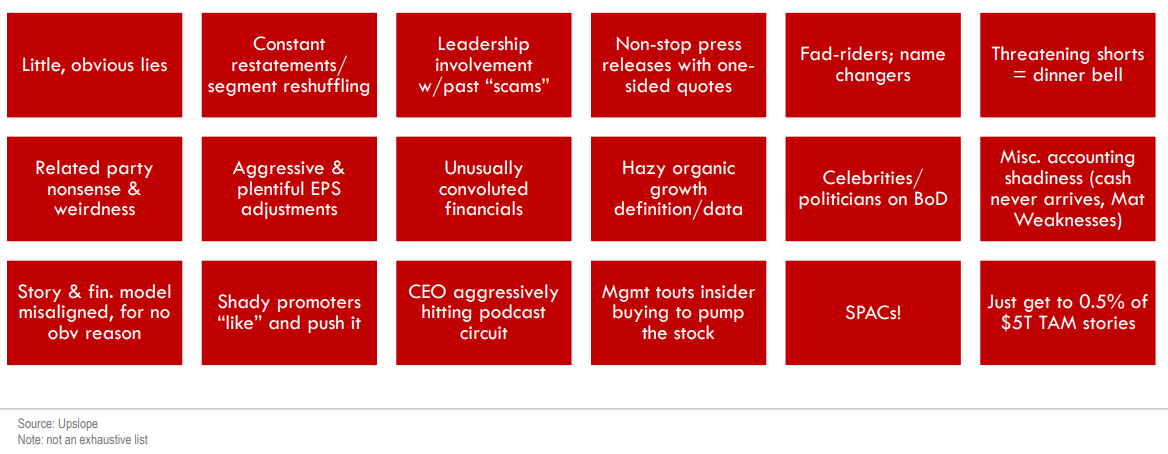

My friend Dan McMurtrie, founder of the hedge fund Tyro, recently flagged a superb presentation on “Creative Shorting” by George Livadas at Upslope Capital Management.2 He said it’s one of the best decks he’s seen on short selling, and I’m inclined to agree. It’s also really funny in parts.

For me, the best slide in the whole presentation was their list of potential red flags in an investment.

The Bear Cave by short-specialist Edwin Dorsey has a pleasingly similar list of 39 red flags. In my personal experience, management obssessing over the behaviour of shorts is one of the most obvious warning signs. One of my other favourites from Dorsey is the surprisingly common occurence of CEOs being interviewed on TV while wearing a hard hat…

The general trend across both lists is obvious: avoid management teams overly focused on anything that’s not the running of the business itself.

When they lose focus, you lose money.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

- Source.

- Does not represent the views of Sapient Capital.