Where we stand, and where we think we’re headed.

[17 minute read/16 minute listen, you can listen to the audio here]

With the market seemingly obsessed with trying to decipher every word uttered by the Federal Reserve, we think it makes more sense to focus on what is more readily observable. To that end, we recently took inventory of what can currently be gleaned with regard to the macro, the markets, the underlying companies that make up these markets and the geopolitical landscape. It’s a perfect time to be writing, because it seems to us that all of these are currently precariously balanced.

At Sapient Capital we always insist that experts tell us first what’s happening right now, then their analysis, then their forecast. We hold ourselves to the same standard.

What just happened?

As we have pointed out before, for much of the past three and a half years, markets around the world were highly influenced by the anomalistic forces of government and central bank policy actions. These unleashed never-before seen cause/effect relationships that upended most theories about how markets price risk and return. The effect of super-sized fiscal policies, negative real interest rates and a near complete, albeit temporary, shutdown of most economies and industries around the world created an enormous economic drought followed by a re-opening tsunami. Since then, the world has been in the process of trying to regain equilibrium. Thus far, 2023 has proved to be a year where the tide was clearly moving back out, but still presenting the challenge of unexpected undertows and cross-currents to manage along the way. At this point, we think it is constructive to both continue to assess the damage while simultaneously thinking about where it’s safe to wade back in.

Inflation: finally returning to manageable

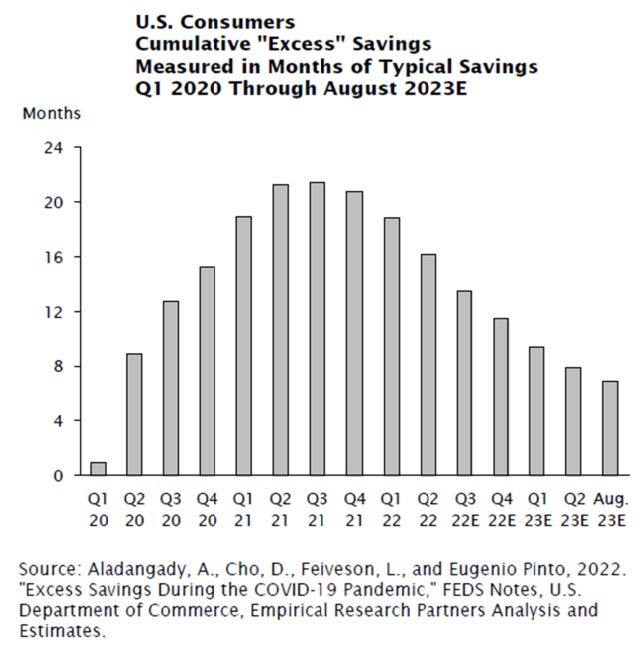

We have all been impacted enough by two years of inflation to know that we really don’t like it at all. Unlike many of the inflation doomsayers of today, we believe that most of this was simply caused by too much fiscal and monetary stimulus chasing too little capacity of goods and services. If 2022 was the year of goods inflation, then 2023 was the year of services inflation. Anyone who took a vacation over the past 6 months involving planes, hotels and restaurants knows this too well. Pent-up demand and a glut of excess COVID-era savings unleashed itself with a vengeance in the 2nd and 3rd quarter. Nevertheless, there are good reasons to believe that we could be nearing the end of this rather bizarre era.

While we don’t believe inflation is returning to 2% anytime soon (as the Fed does), we think 2.75%-3.25% is quite possible once this cycle has fully played out by the end of 2024. Some of the forces continuing this downward trend include lower rents, increasing productivity gains from tech, automation & AI and a state of disarray in Congress. Such disarray should help in tamping down the upward trend in fiscal stimulus and the budget deficit of the past two years. Also posing a headwind to higher inflation is the continuing deterioration in bank liquidity over the foreseeable future. What banks are facing today- falling deposits, increased regulation and slowing loan growth- will only be exacerbated in the next 18 months as the work-from-home trend is likely to drive more commercial (office) real estate into foreclosure.

To be sure, the forces of inflation still have tailwinds from factors such as longer-term demographic contraction of the workforce (wage pressure), tighter commodity markets (under-investments in fossil fuels), negative productivity effects of the green energy transition and de-globalization trends. However, we think the aforementioned headwinds will have an outsized effect over the shorter-term vs these tailwinds.

The U.S. Consumer: on a knife edge

At 65-70% of domestic GDP1, consumer spending has long been critical to the US economic outlook. Here, the picture here is mixed.

- On the positive side are solid wage gains and job growth, low unemployment, strong household balance sheets and excess savings compiled during COVID.

- On the negative side, we see a rapid depletion of these savings (chart below), low housing affordability, high energy prices and a resumption of student loan obligations. Headwinds like these in past cycles often portend meaningful declines in future spending as consumers become more conservative, saving more and spending less.

While wages recently posted a 4.2% annual gain in September, that is being offset by a CPI that is running close to this level, making those wage gains necessary just to make ends meet. Additionally, as we have written about in the past, elevated interest rates combined with higher prices for cars and homes has meant that the consumer is increasingly being priced out of many essential durables purchases. This is most evident and concerning in the housing market, which (along with the energy industry) was a key driver of the US economy in the decade preceding COVID. With the current 30-year mortgage rate nearing 8% (vs 4% in 2019), housing affordability is now at the lowest level in over 30 years, which is depressing both housing starts and existing home sales.2

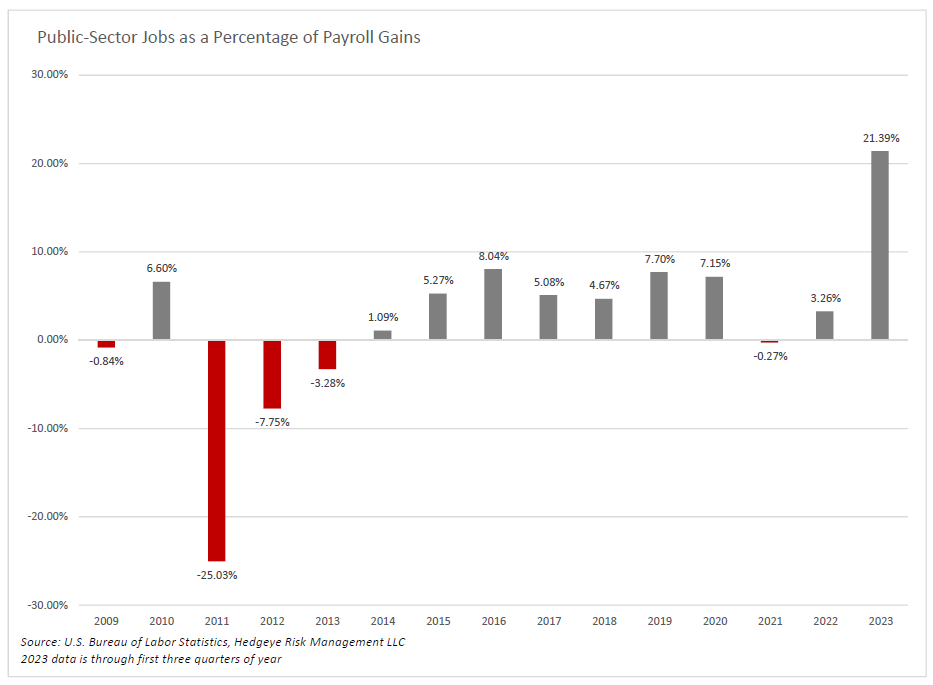

With such a dubious outlook for the consumer, one might wonder what is driving the consistent gains we have seen in wages and job formation. The answer appears to be the continuing accommodative fiscal policies coming out of Washington D.C. In addition to the unprecedented fiscal expansion that took place during COVID, the Biden Administration has overseen the passage of over $2.7T in additional stimulus with the American Rescue Plan, the Infrastructure and Jobs Act and the Chips Act. Since their passage in 2021-22, this spending has contributed to above-trend investment in infrastructure within federal, state and local governments as well as subsidies for semiconductor manufacturing facilities across the country. This added demand-in the face of an already tight post-COVID labor market- has kept wages elevated and made employers willing to do whatever is necessary to retain the employees they have. The chart below highlights how an abnormally high % of recent job gains have been in the public sector.

The Bond Market: lower rates likely

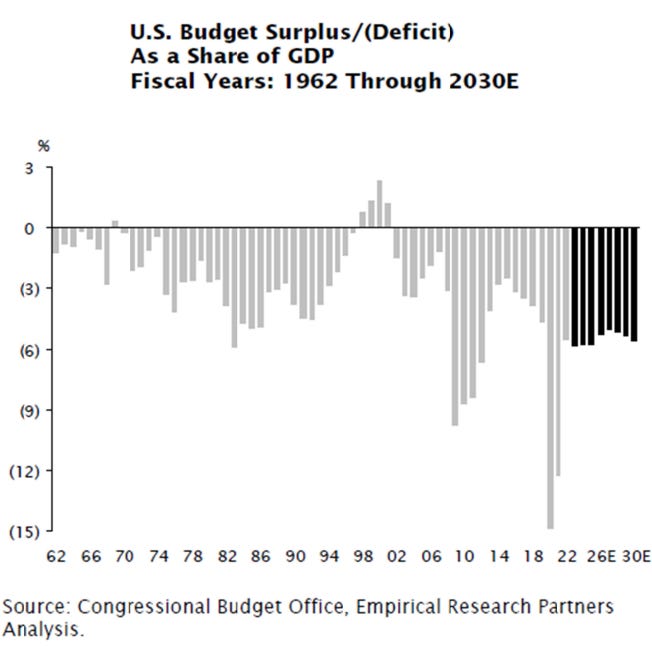

As history has shown, this fiscal stimulus does not come without a cost. For now, that cost appears to be a 15-year high on the 10-year treasury yield (currently flirting with 5%) as the market grows increasingly concerned with the outlook for the budget deficit. Such worry is not without precedent, but over the years we have noticed that budget deficits don’t always seem to matter to the markets….until they do. Then once they do, for a time it seems that it becomes the only thing that matters. While it’s not totally clear that we have entered into such a period now, it does seem oddly coincidental that the August move above 4% on the 10-year came about after the higher inflation numbers of the first half of 2023 seemed to be finally cooling off.

What is clear is that with $35T in debt, the US Treasury is now facing over $1T per year in interest payments at current rates.3 Prospective buyers of these bonds might begin to wonder if a $1T deficit at 5.7% of GDP poses an insurmountable fiscal challenge. Keep in mind that, while 5.7% seems high by recent standards, the budget deficit in 2009 reached as high as 8.5% before the Tea Party was formed to begin holding Congress to task on fiscal discipline. (See chart below)

Regardless of ones view on budget deficits vs interest rates, what seems more important is to figure out where this is taking us. To that end, it doesn’t seem a stretch to assume that, with reduced consumer spending next year, a rolling recession in Europe, worsening bank liquidity, elevated mortgage rates and a deficit that threatens to soak up what little liquidity remains, that we are probably headed for a period of slowing economic growth. If we are right about that, then one has to question the sustainability of 10-year government bond yields that are at a 15-year high. In that scenario, lower long-term rates certainly seem likely.

The Stock Market: cautiously optimistic

For some time now, it has seemed like the stock market has been failing to extrapolate the existence of higher inflation, a hawkish fed and higher for longer interest rates. While that’s possible, what seems more plausible to us is that the stock market has been calling the market’s bluff, refusing to believe that the inflation of the past two years is anything more than cyclical or that higher long-term rates are truly here to stay. We think there is a better-than-even chance that the market is right about this; and should growth slow meaningfully next year with the 10-year yield normalizing below 4%, stocks could actually prove quite resilient. The key question is whether the slowdown in growth results from an economic slowdown (soft landing) or an outright recession.

The current average of the consensus estimates for the S&P 500 earnings for 2023 is $225, which equates to year over year growth of just under 1%.4 Not a great year for earnings, but with the market P/E multiple increasing about 13%, it turned out to be a decent year so far for the market (+14%). For 2024, earnings are expected to grow about 11% to $247.5 Considering our observations on the consumer and the deficit, that seems a bit high to us. If growth is indeed poised to decelerate, we could foresee earnings falling next year between -8% to -12% to $200. But if P/E multiples hold at 18-20x (typical for a trough earnings year), that could result in the market bottoming around 4000 on the S&P500 vs its current level of 4300- hardly a doomsday panic scenario-and likely a bottoming that would be difficult for longer-term investors to navigate and time perfectly.

Of course, the worst-case scenario would be a deep recession where earnings are off by 20% or more. While plausible, we think this is less likely, precisely because we are not coming off of an economic period where there were obvious excesses that needed to be rung out of the system. The past expansion saw no excessive use of debt (consumer and business balance sheets are not overly levered), no overbuilding of houses or infrastructure, no tech bubble. To be sure, there was a bit too much money in private markets going into start-ups and cryptocurrencies, but those excesses have largely been wiped out. Instead, this cycle was marked by, and will long be remembered as, a time when excessive monetary and fiscal policy produced excess demand that confronted severely constrained supply. For the past two years we have been burning off that excess demand while bringing supply back online.

Before leaving a discussion of the stock market, we feel compelled to address the much talked about discrepancy between the broader S&P500 and the “Magnificent 7” stocks; Meta, Apple, Amazon, Google, Nvidia, Microsoft and Tesla. Much has been written about how these seven stocks are up almost 100% in 2023 while the broader market is up only about 14% and that these stocks only comprise 28% of the index but account for 85% of its return.6 Our assessment of this observation is “so what?”. As stock pickers, we are happy to point out that we have owned most of these stocks in our client portfolios at some point during the past year. The reason we have owned them is precisely because they are good companies. While their P/E multiples range from 14-44x (excl. TSLA), their revenue growth averages 13%, their earnings growth averages 61%, their operating margins average 21% and their free cash flow margins average over 16%.7 Rather than complain that these stocks are hiding an otherwise lackluster market, we think that owning these companies was an imperative for growth-oriented managers over the past year.

Geopolitical Risks: watching closely.

Factoring geopolitical risk into any portfolio strategy is difficult at best, primarily because forecasting such risk is nearly impossible. Yet that doesn’t justify ignoring it. The most prominent geopolitical risks facing markets into 2024 remain the Russia/Ukraine conflict, de-risking US/China tensions and the newly initiated war between Israel and Hamas. Most pressing for US markets is the willingness of congress to fund the Ukraine and Israeli conflicts with blank checks into the foreseeable future. Our past discussion on the deficit suggests the likelihood of considerable political push-back towards such requests. Additionally, the coming Presidential election next year will likely put these issues front and center on the campaign trail.

Speaking of elections, the prospect of a new face in the White House in 2025 holds some hope for markets. While the Presidency tends to matter less to fundamentals than to sentiment, the ability of a strong candidate to have a coattail effect in congressional elections can have a meaningful impact on fiscal policy. While too soon to call, a candidate with a platform emphasizing strong fiscal discipline could be well received, particularly if they can pull through a House majority committed to supporting their policy initiatives.

How to Invest:

With all of the aforementioned observations considered, our current view is to be positioned for an economic slowdown as inflation eases and as consumer spending and interest rates normalize downward. We think weaker earnings in 2024 should be expected given the typical 18-month lag between the inversion of the yield curve and its concomitant effect on the economy. With the yield curve inverting in July 2022, we see January 2024 marking the beginning of a meaningful slowdown in the US economy.

For now, this justifies taking a slightly defensive stance while remaining opportunistic. This means taking advantage of abnormally high yields in fixed income portfolios by adding short- and medium-term bonds along the yield curve and focusing exposures in equity portfolios in stocks of companies that are producing predictable, stable growth with low debt and above-average free cash flow generation. Many companies with such characteristics can be found in the technology, communications, consumer and energy sectors. These sectors also are overweighted in Sapient’s internally managed equity strategies.

From the present vantage point, we think risk and return considerations equally favor both stocks and bonds. Therefore, a rational case can be made for balanced portfolios to skew incrementally towards bonds in the near-term while yields remain competitive versus the free cash flow yields on stocks. Over time, as markets begin to reflect the possibility of a slowdown unfolding in excess of current consensus expectations, there should be ample opportunity with periods of heightened volatility to incrementally increase equity exposures.

-Tom Pence, Founding Partner, Sapient Capital.