A quick update on the investing mystery of our age

[5 minute read].

There’s a mystery at the heart of the global economy, and it will determine the fate of trillions of dollars of long-term wealth.

At the start of this year I tried to summarise the dominant investment consensus in 70 words:

“The world is deglobalizing. This means more goods will be produced locally and more infrastructure will have to be built. This will boost commodities and inflation. That should end the era of low rates. As a result, value will outperform growth, and emerging markets will benefit. The world will pivot from virtual goods back to real goods. High multiple, speculative investments and big tech will suffer. This should benefit active managers.”

Thank God this wasn’t entirely our view. The market is a machine designed to cause the maximum pain to the most people. So we’ve obviously just had had a ludicrously narrow rally led by megacap tech. The S&P 500 is up 8% so far this year. But the rally has been so narrow that the market would be down since February without the “big 7” tech stocks. This has left us asking the question: where do we stand now in terms of the balance between the virtual and physical world?

Last week we hosted a call for our clients with one of our favourite macro and geopolitical experts, Marko Papic at Clocktower. He believes that all roads lead to capex.

He disagrees with what he calls the “geopolitical tourist” first-order assumption that wars cause sustained commodity inflation. This meant he was brilliantly tactically short commodities in 2022, due to overstated geopolitical risks. But he still he believes we are in a commodity supercycle decade: the multipolar macro context is inescapable. Wars get priced-in quickly, but the slow fracturing of a stable global order takes years. The absolute key for him is this:

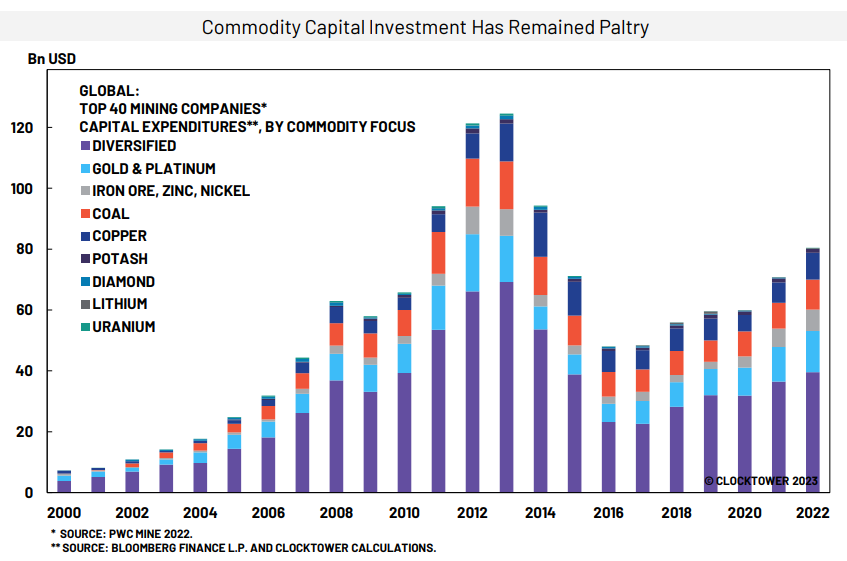

The paradox of our decade is that the capex needs of a multipolar, environmentally conscious, world are enormous. But, nobody wants to invest in capex for commodities! This is untenable.

Misguided ESG policies have helped burn down the bridge to sustainability while we were still walking across it. So now we are in a very strange situation where we’re being too “environmentally conscious” to produce enough of the commodities we need to make the green transition. Another one of our research partners flagged a wild statistic from Mining.com editor Frik Els:

“At Apple’s market capitalization alone—even after shedding nearly $750 billion in 2022—you can buy the world’s 50 most valuable mining companies, the next 50, and have enough left over to snap up three years of global copper mine production and buy 2022’s seaborne iron ore—all of it.”

The combination of low valuations, high costs for new projects, declining industry capex and generous free cash flow points to more M&A, which should also raise the sector’s valuation.

The obvious caveat is that commodities can be terrifyingly cyclical. Stan Druckenmiller (also known to rapidly change his mind) summed up this tension recently (via Frederik Gieschen):

Copper is complicated. Copper is the wildest bullish supply demand situation ever seen. But if you get a hard landing, I’m not sure I want to own it. But I definitely want to own it long term because the inventories are crazy. And this whole EV thing is going to happen.

So what’s the steelman (pun intended) response as to why this could be wrong? Strategist Russell Napier thinks we’ve moved from a market dominated by central bankers to one dominated by politicians. And relying on politicians is always… tricky. So one plausible outcome is we could spend a long time talking about reshoring and fiscal stimulus and it never actually happens. Global trade has mostly shrugged off the deglobalization narrative, so politicians continue to talk tough and do relatively little. Moreover, many nation states are now less powerful than multinational corporations.

Another argument is that it’s simply not very sensible or realistic to rebuild domestic capabilities, especially in ludicrously complex areas like semiconductor fabs. According to Melius Research, semis account for 56% of the $330bn of North American megaprojects announced since 2020. That being said, my friend Liberty flagged a sobering interview with Gregory C. Allen about China’s chip ban response:

I mean, imagine if in oil, Saudi Arabia, Iran, Iraq, Russia, Venezuela, all come offline on the same day and stop producing oil — that’s really what you’re talking about with the Taiwan war. So that’s going to lead to an absolute economic apocalypse and China is not going to be spared from that by any stretch of the imagination.

So it may seem silly to try to build a semi fab in Arizona for five times the cost of a Taiwanese equivalent, but it might actually be geopolitically prudent in the very long term. And that’s the timeframe we should be interested in.

For me, the most persuasive argument has always been Vaclav Smil’s straightforward math that replicating the post-1990 Chinese experience in lower income countries would amount to a 15x increase of steel output, a more than 10x increase in cement production, a more than 2x in ammonia synthesis, and a more than 30x increase in plastic synthesis. Put a little more tangibly- if those countries whose standard of living is today where China’s was in 1999 were to achieve just a tenth of China’s recent growth, they would experience a 10x increase in car ownership and a 40x increase in the number of air conditioners. This has little to do with decarbonization or greentech, but those would be meaningfully incremental.

The unstoppable force of global growth is on a collision course with the immovable object of political incompetence.

Something’s gotta give.

In a war, don’t pick sides, buy the arms dealers. While that may be literally true in terms of defense stocks, it’s also a solid framing for this investing paradox. There are higher-quality investments that are the second or third derivative of this theme, and that’s where we’re focused for now.

Related Reading.

- Article: The Real Winners of the Coming Capex Tsunami (12min read). A great, short piece from my friend Chris Bryant at Bloomberg on the realities of semi capex spending. “I think I have more concrete trucks working for me today than any other human on the planet,” Intel boss Pat Gelsinger. Chris then wrote a very Smil-esque follow-up on cement shortages. His overall conclusion is similar to ours:

- “With capex poised to boom at last, investors should look for companies able to capture a bigger slice of that spending. In a gold rush, it pays to sell shovels.”

- “With capex poised to boom at last, investors should look for companies able to capture a bigger slice of that spending. In a gold rush, it pays to sell shovels.”

- Article: The new industrial policy, explained (18min read). If the primary obstacle to progress is political gridlock, economist Noah Smith wrote an optimistic article arguing that the U.S. industrial policy is unusually bipartisan.

- “These fights over the nature of industrial policy will be fierce, and sometimes even bitter. But we shouldn’t let them obscure the larger point, which is that both parties now agree on the need for industrial policy, and on many of its broad contours. It appears that America has found its new economic policy consensus. What remains to be seen are the results — how effectively the new policy regime can be implemented, and how well it achieves its goals.”