A defining question for the next decade.

[8 minute read]

One of the most helpful framings to understand markets and politics in the Western world has come via N.S. Lyons’ distinction between “Physicals” and “Virtuals.”

The virtuals tend to be coastal elites, focused on financial or digital abstractions. The physicals, as their name suggests, are involved in more real-world occupations and tend to be based in suburbs or rural areas.

The most relevant distinction between Virtuals and Physicals is that the Virtuals are now everywhere unambiguously the ruling class. In a world in which knowledge is the primary component of value-added production (or so we are told), and economic activity is increasingly defined by the digital and the abstract, they have been the overwhelming winners, accumulating financial, political, and cultural status and influence.

Writer Tomas Pueyo recently provided compelling statistical support for the argument that digital technology has been a major cause of inequality. One statistic caught my eye: of the top 50 most common jobs in the US, 47 of them have been around for 60 years or more.

The only three new ones are, you guessed it, linked to the digital economy: software developers, support agents, and computer information analysts. In other words, two of the only three new jobs that employ a lot of people are trying to automate everybody else’s job.

In markets, this dynamic is perfectly illustrated by one of my favourite charts:

The last two decades have been dominated by Internet monoliths. It seemed for the last twelve months that their time in the sun was over, but there was a monster rebound last quarter.

I think the question that will define the investing world more than any other is how far this rebalancing from Virtuals to Physicals has left to go.

Forecasts are for meterologists. Our policy here at Sapient Capital is to “see the present clearly” first.

What is happening right now?

In the US, the Wall Street Journal has already dubbed this the “richcession.” Layoffs have been focused in higher-end tech, while leisure and hospitality have continued to boom. We’ve also seen a stark reversal of decades of wage stagnation. The bottom 10% of earners have seen nearly double the wage growth of the top 10%. The wealthier have also been harder hit by asset price declines.

The regional banking crisis has impacted depositors that are typically wealthier than average. Silicon Valley Bank itself exemplifies the Virtuals: concentrated in San Francisco, with an “extremely online” clientele and dealing predominantly in digital business models.

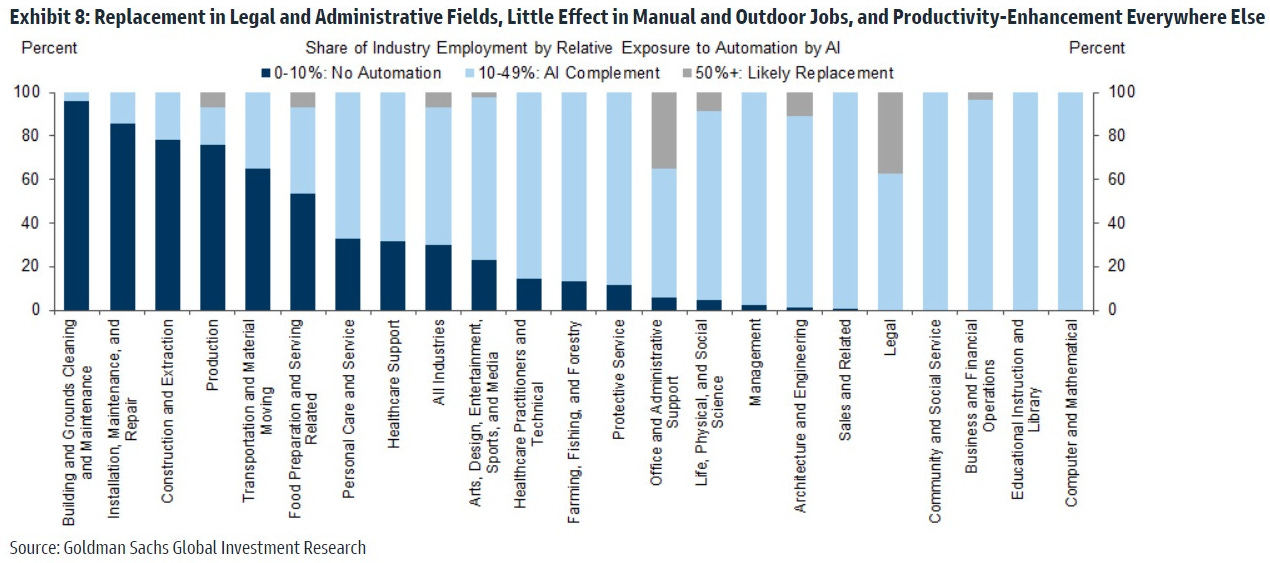

It’s dangerous to forecast technological unemployment, but the current paradigm shift in A.I. has made it uncertain which virtual jobs will be made obsolete right now. A recent Goldman Sachs paper reached the obvious conclusion that digital jobs are being disrupted first, with minimal effect on manual & outdoor.

For the virtual class, the only certainty is now an unprecedented level of uncertainty. Until we know the full impact of the disruption, it’s making large swaths of the tech sector so volatile as to be almost uninvestable. For the Internet monopolies, A.I. has the rare potential to be a winner-takes-all phenomenon. It’s why the arms race is so fierce. The billionaires may yet eat the millionaires.

Tyler Cowen is generally an A.I. optimist, but he believes it has already ended a relatively placid period of human history.

“Hardly anyone you know, including yourself, is prepared to live in actual “moving” history. It will panic many of us, disorient the rest of us, and cause great upheavals in our fortunes, both good and bad…. No one is good at predicting the longer-term or even medium-term outcomes of these radical technological changes.”

Reality Bites Back.

Despite claims of a AI paradigm shift in the virtual world, when you put down your phone and look around, nothing seems to have changed. Yet. Maybe it won’t.

But the physical world has also accelerated in a much more conventional and tangible way. The Ukraine war, supply chain fractures, inflation spike and energy crisis have sharpened the focus on domestic infrastructure.

The Chinese government has seemingly already picked a side in the conflict between Physicals and Virtuals. We recently hosted our favourite China expert Dan Wang for a client call. He has argued that China has predominantly pivoted away from virtual worlds towards making “steel, semiconductors and babies.” Instead of the abstracted Silicon Valley and Wall Street, they admire the German model of niche manufacturing firms embedded in a well-regulated market system with a large “physical” workforce.

In stark contrast, economist Noah Smith recently wrote a damning piece on America’s inability to actually build anything. At $2.5 billion per mile, construction costs for New York’s Second Avenue Subway were 8 to 12 times more expensive than similar subway projects in Italy, Istanbul, Sweden, Paris, Berlin and Spain. It seems like U.S. semiconductor fabs are running into similar problems, coming out 4-5x more expensive than their Taiwanese counterparts.

“What matters is not how big America’s spreadsheet numbers are, but how much physical stuff we get. And yet as a society we’ve decided to award people with stasis instead of stuff.”

The “virtual” spreadsheet dollars in legislation have poorly translated to “physical” shovels in the ground. And the shovels still matter!

In many ways San Francisco is a grim metaphor for this dynamic. Digital innovation has generated concentrated wealth that’s unprecedented in modern history. But the immediate physical world has fallen into disrepair. Worshiping the brain at the cost of the body.

Last year I was frankly embarrassed when I read Vaclav Smil’s latest book “How The World Really Works.” As a fully paid-up member of the coastal virtuals, I realized how utterly I had failed to grasp the scale and energy intensity of the modern physical world.

Smil’s “four pillars” of cement, steel, plastics and ammonia are essential, energy intensive and utterly embedded in the fabric of our limitlessly complex society.

For example, the world now consumes more cement in a single year than it did during the entire first half of the 20th century. It also degrades over time, which means it needs to constantly be replaced. Currently there are no commercially available mass-scale alternatives that can displace any of the established processes for producing the four pillars.

Moreover, replicating the post-1990 Chinese experience in lower income countries would amount to a 15x increase of steel output, a more than 10x increase in cement production, a more than 2x in ammonia synthesis, and a more than 30x increase in plastic synthesis.

In short, there is still huge demand to build physical stuff. And yet due to a confluence of factors, from ESG to misaligned policy, we have not been producing the commodities required to build that stuff.

Where Two Worlds Meet.

Obviously the Physicals/Virtuals distinction is crude, and it’s been getting blurrier for decades. In fact, the most interesting place is usually where they meet. I suspect it will determine the winners of the next decade.

- How will A.I. eventually affect the physical world? Will it? Nuclear fusion? Automation? Biotech?

- Where will government “spreadsheet numbers” meet reality? With the state taking a more active role in strategic industries, where is this producing investment opportunities? Whether it’s Chinese solar or French utilities, this isn’t always positive for equity holders.

- What is “irreducible”? We still need “the four pillars” as well as food, energy and staples. But this doesn’t guarantee they’re great investments as supply and demand whip prices around.

Regular readers will anticipate my general conclusion. In its present iteration as a “universal intern”, A.I. requires humans to ask the questions and judge the answers. I don’t think “prompt engineer” is a mass-market job. But I do think that there will be a massive premium on our individual “relevance realization” or wisdom. That’s where our judgement meets their analysis.

For example, one of the cute demonstrations of the limitations of A.I is that it can’t tell you which of the millions of opinions on A.I. to take seriously. But I did enjoy Scott Alexander’s wry suggestion that America apply its gift for physical stasis to the A.I. arms race in the virtual world:

We designed our society for excellence at strangling innovation. Now we’ve encountered a problem that can only be solved by a plucky coalition of obstructionists, overactive regulators, anti-tech zealots, socialists, and people who hate everything new on general principle. It’s like one of those movies where Shaq stumbles into a situation where you can only save the world by playing basketball. Denying 21st century American society the chance to fulfill its telos would be more than an existential risk – it would be a travesty.

Have a great weekend.

We’re going to be hosting a series of client calls over the next few months on these topics.

Reply to this email if you’d be interested in attending.

Finally, for those readers that share my profound love of melodic dance sets, here’s the best one I’ve heard in months: Luttrell for Anjunadeep.