A New White Paper From Sapient Capital

INTRODUCTION

We believe private credit offers investors an established asset class, a broader opportunity set than the public credit markets, and the potential for attractive risk-adjusted returns in a less efficient market. Private credit has historically delivered stable, uncorrelated returns with enhanced income potential. In this paper, we highlight private credit as an attractive alternative to traditional fixed income that can provide diversification benefits and be considered a strategic allocation in portfolios.

Sapient Capital is finalizing due diligence on a private credit fund and we are excited to introduce this private credit investment opportunity to you in the first quarter. In the meantime, we want to provide education and background on why we believe you should consider adding private credit to your investment portfolio.

WHAT IS PRIVATE CREDIT?

Private credit, also known as direct lending, is a privately negotiated loan made by non-bank lenders. In many instances, a private equity firm acquires a company and finances the purchase price with equity and debt. The debt portion may be financed with a loan from a bank (the bank in turn may hold the loan on its balance sheet or syndicate it to a group of investors), by issuing debt in the public markets, or by seeking a loan from a lender in the private markets. There are many reasons why borrowers turn to private credit as a source for financing, including efficient and timely execution of a loan, certainty of terms, and ability to maintain confidentiality (public debt requires broad disclosure of financial information).

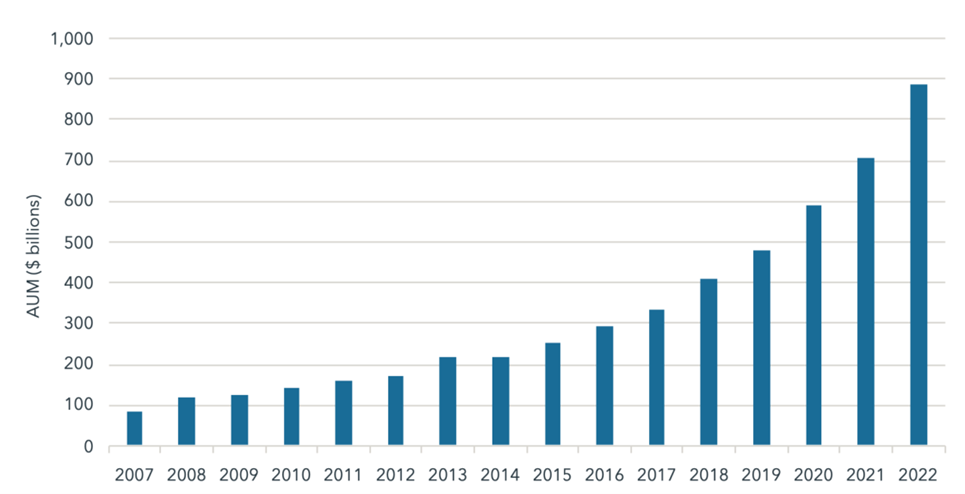

As shown in Exhibit 1, private credit assets under management have increased substantially over the past fifteen years, and are approaching $900 billion (compared to less than $100 billion in 2007). In addition, private credit represents a 24% market share of the $3.8 trillion in assets under management in the U.S. below investment-grade credit market, up from 5% market share in 20051. The growth of the private credit asset class has been fueled by banks pulling back as a source of lending due to tighter lending standards and more strict regulatory requirements after the Global Financial Crisis.

Exhibit 1: The Growth of Private Credit, Assets Under Management

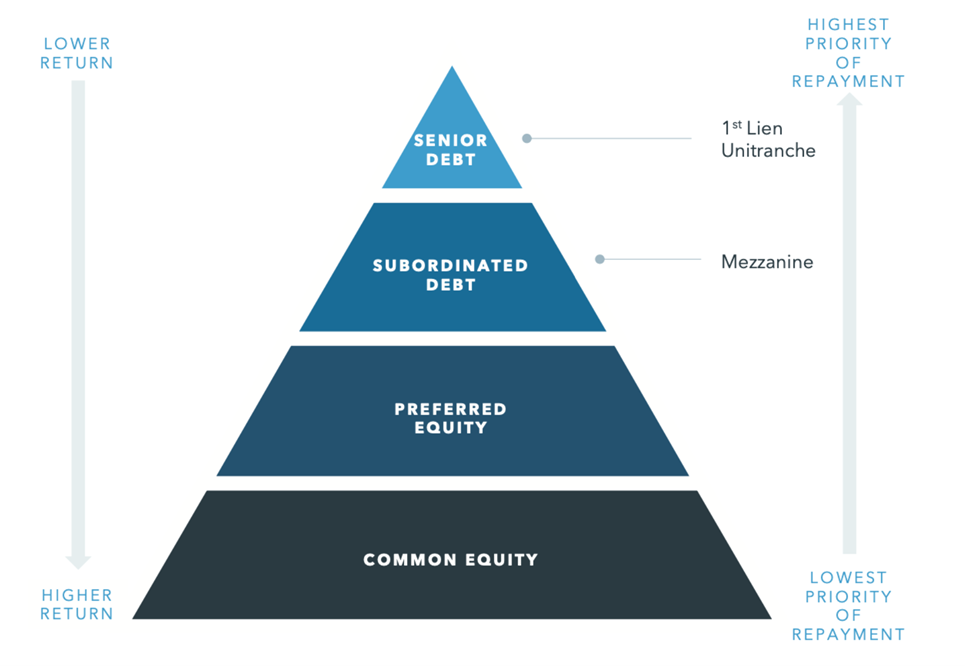

To simplify private credit, think about your home mortgage. You went to a lender, made a 20% down payment, borrowed 80% of the home’s value with a mortgage, and make scheduled payments to pay-off the loan. Similarly, a private lender may provide a senior secured loan equal to 40% of the company’s value with 60% of the value in contributed equity or subordinated debt. Like the mortgage company, the private credit lender has a cushion, or downside protection, in the event there is a decline in the value of company. As a result, the historical loss rate on private credit loans has been low, approximately 1.0% per year, compared to an annual loss ratio of 1.5% for public, unsecured high yield bonds.2 Some private credit lenders primarily focus on being positioned at the top of the capital structure, in senior debt with first claim on a company’s assets, as shown in Exhibit 2.

A private credit loan typically exhibits the following characteristics:

- A private equity firm invests equity in a company, typically for at least 50% of the capital structure, and borrows the remainder from a private credit lender.

- The private financing is typically offered with interest payments at a spread above a floating reference rate and a floor on the minimum interest rate. A floating rate offers an inflation hedge if interest rates rise and a rate floor can soften the impact if interest rates fall.

- Private credit lenders typically invest in senior secured securities, which means they have priority on company assets if there is a default. A high quality, private equity firm can provide additional protection against default with continuous oversight and the ability to make an equity infusion, if necessary.

- The term of the loan is usually in the five- to seven-year range.

Exhibit 2: Capital Structure

WHY INVEST IN PRIVATE CREDIT?

Private credit can complement traditional fixed income strategies and offer income generation, return enhancement, capital preservation, and diversification benefits.

Income generation. Gross yields for private credit have averaged 4% above publicly traded, high yield bonds over the past 15 years,3 which is a relevant comparison of credit-driven asset classes. Private credit, like private equity, is an actively managed asset class with fees that will lower the yield advantage. However, private credit managers may finance some of their loan portfolio to enhance income and return. Keep in mind that the income component from taxable, fixed income investments is taxed at ordinary income tax rates, if subject to federal income tax.

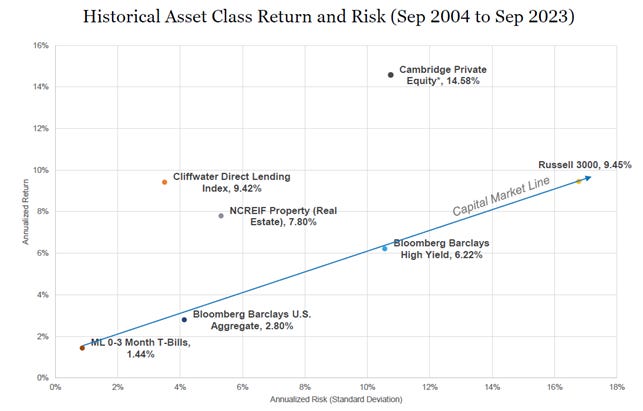

Return enhancement. Exhibit 3 shows that private credit, as referenced by the Cliffwater Direct Lending Index (“CDLI”), generated a 9% annualized long-term return, which outperformed high yield bonds by 3% per year. In addition, the return on private credit was comparable to U.S. public stocks (Russell 3000 Index) with significantly more downside protection.

Exhibit 3: Private Credit Offers Attractive, Long-Term Risk Adjusted Returns

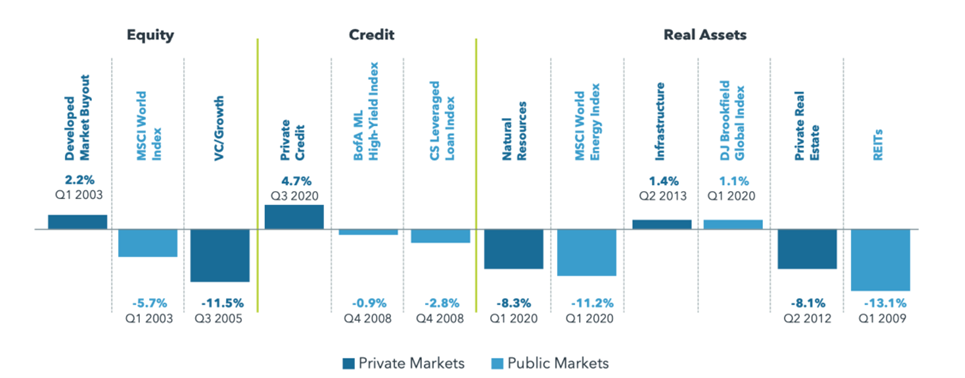

Capital preservation. Private credit has defensive characteristics associated with being senior in the capital structure. However, private credit is a segment of the below-investment grade credit market, so there is default risk. Hiring an experienced manager who selects securities after detailed research and analysis mitigates downside risk. In addition, since the securities are not publicly traded, private credit tends to be less volatile than publicly traded securities. In 2008 and 2020, calendar years in which the market environment was tested due to a financial crisis and a global pandemic, private credit protected capital reasonably well relative to many asset classes. In 2008, the CDLI’s total return was -7%, and in 2020 the CDLI fell 5% in the first quarter of 2020, but ended up more than 5% for the year. Exhibit 4 analyzes the lowest five-year annualized performance by asset class over the past 25+ years. Private credit generated the best results with a 4.7% annualized return during its worst five-year period.

Exhibit 4: Lowest 5-Year Annualized Performance Across Equity, Credit, and Real Assets (1995 – 2022)

Diversification. As opposed to fixed-rate bonds, private credit loans are largely floating rate providing an inflation hedge in a rising rate environment. For example, when interest rates rose significantly in 2022, the investment-grade, fixed income market had its worst year ever as the Bloomberg U.S. Aggregate Index fell 13% and high yield bonds posted a double-digit percentage loss, while the CDLI’s total return was 6%. The floating rate nature of private credit is typically a unique feature compared to traditional fixed income securities, providing a lower correlation to an existing fixed income portfolio and adding diversification benefits.

Credit expert Howard Marks, the co-founder of Oaktree Capital Management, is excited about future opportunities for fixed income investors in credit-related securities. Since the Global Financial Crisis, yields in the fixed income markets have been very low. But now investors can earn an attractive return. Howard says, “…investors today can get equity-like returns from investments in credit.” He continues, “And, importantly, these are contractual returns.”4 Equity returns, in the short-to-medium term, may depend on market sentiment and psychology. However, for credit investors, the return comes primarily from the contract between you and the borrower. Therefore, the sources of return on stocks and credit-related securities is different, providing further diversification benefits to include private credit in an investment portfolio.

RISK CONSIDERATIONS

While the private credit market is an attractive opportunity, there are potential risks investors should consider. Risks may include, but are not limited to, the following:

- Credit risk. Private credit funds may primarily hold debt in below-investment grade borrowers. Therefore, there is risk of default.

- Liquidity. Private credit funds are long-term investments and liquidity may be limited. Investors should carefully consider their liquidity needs to determine whether and how much to commit to private credit.

- Leverage. Private credit funds may use leverage, which can amplify both gains and losses.

- Manager Selection. Selecting an experienced private credit manager that conducts detailed due diligence with risk management capabilities is very important.

- Fees. Private credit fund managers charge an annual management fee and may charge performance fees, which represent a portion of profits generated by the fund.

CONCLUSION

We believe private credit can help meet the demand for income, return, and diversify a portfolio primarily focused on traditional fixed-rate securities. Over the years, clients have invested in private equity to boost potential portfolio returns. Similarly, clients can improve the risk and return profile of their investment portfolio by broadening the opportunity set of fixed income investments by including private credit as a long-term strategic allocation.

We are excited to introduce a private credit opportunity to you very soon. Feel free to reach out to us with any questions.

-The Sapient Capital Advisor Team

IMPORTANT DISCLOSURES

The views expressed in this presentation are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

The information provided is for educational and informational purposes only and does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. You should consult your attorney or tax advisor.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability, or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. The principal risks of the advisor’s investment services are disclosed in the publicly available Form ADV Part 2A.

This document is for your private and confidential use only, and not intended for broad usage or dissemination.

Past performance is no guarantee of future returns.

Cliffwater Direct Lending Index (“CDLI”) seeks to measure the unlevered, gross of fees performance of U.S. middle market corporate loans, as represented by the underlying assets of Business Development Companies (“BDCs”), including both exchange-traded debt and unlisted BDCs, subject to certain eligibility requirements. The CDLI is an asset-weighted index that is calculated on a quarterly basis using financial statements and other information contained in the U.S. Securities and Exchange Commission (“SEC”) files of all eligible BDCs. Cliffwater believes that the CDLI is representative of the direct lending asset class.

Russell 3000 Index is a capitalization-weighted stock market index that seeks to track the entire U.S stock market. It measures the performance of the 3,000 largest publicly held companies incorporated in the United States based on market capitalization.

Bloomberg U.S. Aggregate Bond Index represents securities that are SEC-registered, taxable, and dollar denominated. The index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

Bloomberg U.S. Corporate High Yield Index (Bloomberg High Yield) measures the USD-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch and S&P is Ba1/BB+/BB+ or below. Bonds from issuers with an emerging markets country of risk, based on the indices’ EM country definition are excluded.

The MorningstarLSTA U.S. Leveraged Loan Index is a market value-weighted index designed to measure the performance of the institutional leveraged loan market in the United States based upon market weightings, spreads and interest payments, including Term Loan A, Term Loan B and Second Lien tranches.

The NCREIF Property Index is a quarterly time series composite total rate of return measure of investment performance of a very large pool of individual commercial real estate properties acquired in the private market for investment purposes only. All properties in the index have been acquired, at least in part, on behalf of tax-exempt institutional investors.

The Cambridge Private Equity Index is based on horizon returns data compiled from institutional-quality buyout, growth equity, private equity energy, venture capital and mezzanine funds, including fully liquidated partnerships, formed between 1986 and 2017.

The BofA Merrill Lynch U.S. 0-3M Treasury Bill Index tracks the performance of the U.S. dollar denominated U.S. Treasury bills publicly issued in the U.S. domestic market with a remaining term to final maturity of less than 3 months.

Sapient Capital, LLC (“Sapient Capital”) is a Registered Investment Advisor with the U.S. Securities and Exchange Commission (“SEC”). Sapient Capital provides investment advisory and related services for clients nationally. Sapient Capital will maintain all applicable registration and licenses as required by the various states in which Sapient Capital conducts business, as applicable. Sapient Capital renders individualized responses to persons in a particular state only after complying with all regulatory requirements, or pursuant to an applicable state exemption or exclusion. For additional information, please visit our website at sapientcapital.com

If you have any questions, please contact us at (317) 719-0157.

1 Blackstone, as of December 31, 2022.

2 Cliffwater 2023 Q3 Report on U.S. Direct Lending.

3 Cliffwater 2023 Asset Allocation Report (for period of September 2004 to September 2022).

4 See Marks’ “Further Thoughts on Sea Change”